Apple’s story is truly inspiring from starting in a small California garage to becoming a tech giant worth nearly $3 trillion in 2025. This incredible growth didn’t happen overnight.

What’s impressive about Apple is how it keeps bringing fresh ideas and new products to the market. That creativity has helped the company grow quickly and stay financially strong year after year.

I’ve looked into Apple’s history, its early challenges, how its market value climbed, and what keeps it at the top. In this article, you’ll get a straightforward look at how Apple reached this massive success and why it continues to dominate the tech world.

Key Takeaways: Apple Net Worth 2025

- Apple’s net worth has reached monumental heights and is valued at $3.28 Trillion as of May 2025.

- Apple’s market capitalization provides insight into its current financial magnitude.

- Financial health and industry positioning are critical components of the company’s valuation.

What Is The Current Apple Net Worth?

As of May 22, 2025, Apple’s net worth, or market capitalization, is valued at approximately $3.28 trillion. This valuation is based on the current stock price multiplied by the number of outstanding shares.

In January 2022, Apple achieved a significant milestone by becoming the first company to hit a market value of $3 trillion. Since then, the market has fluctuated, but Apple’s valuation remains among the highest globally.

I’ve summarized Apple’s recent market cap history in the table below:

| Year | Market Cap |

|---|---|

| 2022 | $2.066 trillion |

| 2023 | $2.994 trillion |

| 2024 | $3.863 trillion |

| 2025 | $3.281 trillion* |

Apple’s financial stability is reflected in its consistent net income growth over the years.

The company’s varied portfolio, including the iPhone, iPad, Mac, and services, contributes to its mighty financial health despite unpredictable iPhone sales and occasional supply chain challenges.

Source: nytimes.com

Steve Jobs and Tim Cook’s Net Worth :

At the time of his death in 2011, Steve Jobs’ net worth was around 10.2 billion USD, which later was divided between his wives, Laurene and Lisa Brennan.

On the other hand, Apple’s current CEO Tim Cook estimated net worth is around 2 billion USD as of March 2024.

Historical Growth:

Apple’s net worth has experienced significant growth since its inception, reflecting the company’s innovation and market expansion success. This growth trajectory can split into separate phases.

1. Early Years:

Apple was founded in 1976 and rapidly gained attention with the introduction of the Apple I and Apple II computers.

The company’s emphasis on user-friendly design and effective marketing strategies created a strong base for its future growth.

2. Rise Of Mobile Devices:

The launch of the iPhone in 2007 marked a significant shift in its growth, effectively transforming the telecommunications market.

The net worth increased as the demand for smartphones increased. Plus, each iPhone release contributes to the growing market capitalization.

3. Services And Variety:

In recent years, Apple has become involved in software-based services such as iCloud, Apple Music, and the App Store.

Moreover, the company’s focus on creating a strong ecosystem has led to a steady revenue stream, supporting the continued growth of Apple’s net worth, as represented by a market cap of $2.8 trillion as of early 2025.

Market Capitalization Trends:

Apple’s market capitalization has fluctuated significantly over the years.

This indicated the company’s dynamic nature in response to various factors, including stock market performance and investor sentiment.

1. Stock Market Performance:

Apple Inc., recognized globally for its innovative products and services, has consistently been a significant performer on the stock market.

The company had a market cap of $2.774 trillion as of March 2024.

The company’s stocks have experienced a rush in value due to various factors, including strong financial performance, good product sales, and strategic corporate decisions.

Source: Companies Market Cap

2. Investor Sentiment:

Investors’ confidence in this remains high, supported by its continuous growth and capacity to maintain a competitive advantage in technology innovation.

Apple’s market cap was reported at $2.797 trillion by the end of February 2025.

It reflected investors’ positive expectations and trust in the company’s prospects. This view is important as it greatly influences stock pricing and market capitalization.

Source: Macro Trends

Financial Health Indicators:

Examining the financial health of Apple Inc. involves its revenue streams, profit margins, and debt and asset analysis. These elements are crucial for investors and stakeholders to evaluate the company’s economic stability and growth potential.

1. Revenue Streams:

The company’s revenue is generated from various sources, primarily including its product sales like the iPhone, iPad, and Mac, as well as services like the App Store, Apple Music, and iCloud.

In a recent report, I discovered a big scoop saying Apple achieved record revenue of $90.1 billion in the fourth quarter, representing an 8% increase year over year.

2. Profit Margins:

The company’s profits can be tracked through its profit margins, which reflect its efficiency in turning revenue into actual profit.

Figures suggest that Apple’s quarterly earnings per small share rose to $1.29. The 4 percent rise from the previous year indicates strong profit margins.

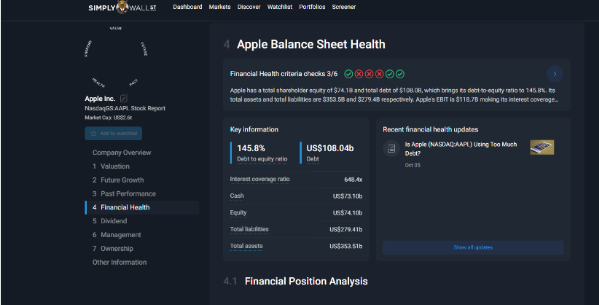

3. Debt And Asset Analysis:

When evaluating Apple’s financial health, its debt and asset analysis provide insights into its economic influence and stability.

Despite a total debt of $108.0 billion, its debt-to-equity ratio stands at 145.8%.

Meanwhile, the company’s total assets amount to $353.5 billion, with total liabilities of $279.4 billion.

Such figures reveal that this company maintains a considerable level of assets relative to its debts, as reported by Simply Wall St.

Market Share & Revenue:

When evaluating Apple’s net worth, it is important to compare its performance against that of its leading tech industry competitors. It shows where the company stands in the market and its success compared to its competitors.

Hence, let’s look at Apple’s market share and compare its revenue and profit with other industry giants.

1. Market Share:

The telecommunication industry leader maintains a robust presence in various sectors, including smartphones, computers, and tablets.

In 2022, iPhone sales constituted a significant portion of the company’s net sales, outpacing other products such as MacBooks and iPads.

The brand’s authority is particularly marked in the smartphone industry, where it competes closely with Samsung.

2. Revenue And Profit Comparisons:

In terms of revenue, Apple’s financial reports highlighted a total of $394.33 billion for the financial year 2022. From the success stories I read while researching, it left a mark on the economy.

Alphabet, the parent company of Google, reported revenues of $307.39 billion for 2023 as these tech giants compete for market leadership.

Microsoft also remains a key competitor, with its revenue reaching $168.09 billion in fiscal year 2021, representing substantial growth over a five-year trajectory.

Comparatives from competitors indicate that this tech giant has a strong financial reputation within the tech industry.

Factors Affecting Net Worth:

Apple’s net worth depends on several things. These things play a big role in how much money it has.

1. The Economy:

How well the economy is doing affects Apple’s net worth greatly. When the economy is stable and people have money to spend, it helps its sales and profits.

However, Apple’s sales and profits can go down when the economy is not doing well and people need more money to spend.

For example, Apple was the first company to be worth $3 trillion, which showed that the economy was doing well and people believed in the company at that time.

2. New Products:

Apple’s focus on making new products is very important for its financial growth. The company’s ability to keep making cutting-edge technology helps it stay ahead of other companies.

Products like the iPhone have made Apple a leader in the market. The new products and services that Apple keeps introducing also play a big role, as they constantly attract customers. We already know about the Apple Vision Pro, which is available all over the internet!

3. Supply Chain Management:

Managing its supply chain is crucial for Apple’s net worth. Working well with its suppliers ensures that Apple can make enough products to meet the demand.

However, when there are issues with the supply chain, such as when there are not enough iPhone supplies, it can limit the company’s sales and hurt its profits.

How well Apple can handle these challenges really affects how much money the company makes.

Also Checkout:

Conclusion: Apple’s Market Value Stands Strong at $3.28 Trillion in 2025

Apple’s rise from a humble startup to a company now worth over $3.28 trillion is nothing short of remarkable. Even after dipping from its $3.86 trillion peak in 2024, Apple’s resilience shines through. Its strong product lineup and growing services continue to fuel consistent growth.

From reaching the $3 trillion milestone in 2022 to staying above that mark in 2025, Apple proves that innovation and smart strategy go hand in hand. These numbers reflect more than just success they show lasting dominance in the global tech landscape.